EXECUTION MODEL

Providing best aggregated pricing, fast execution and the highest possible likelihood of execution.

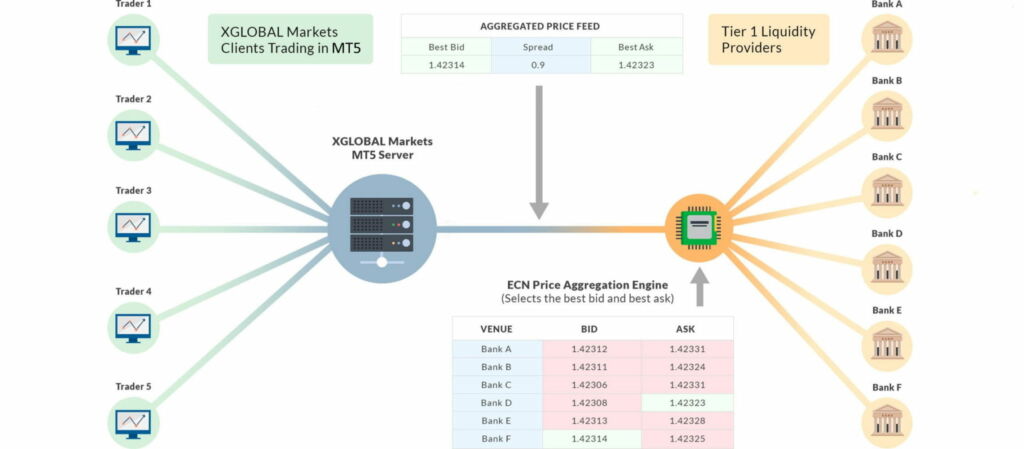

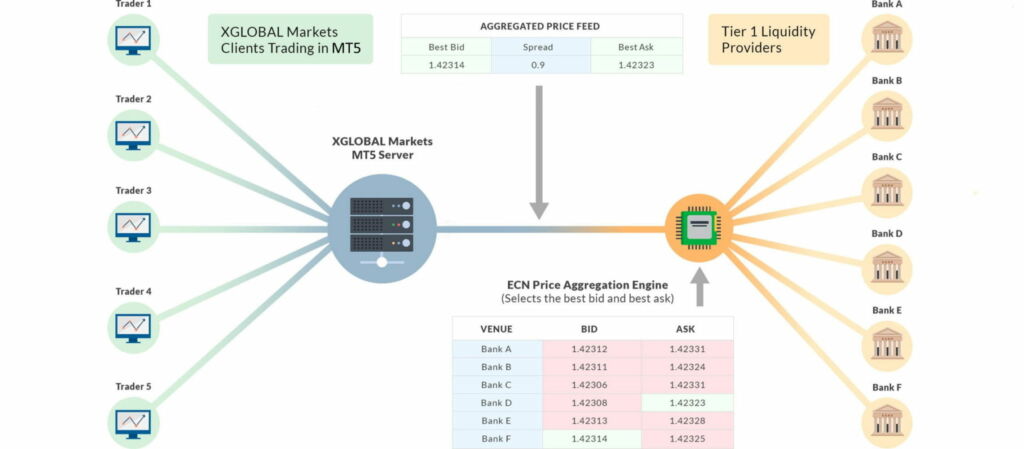

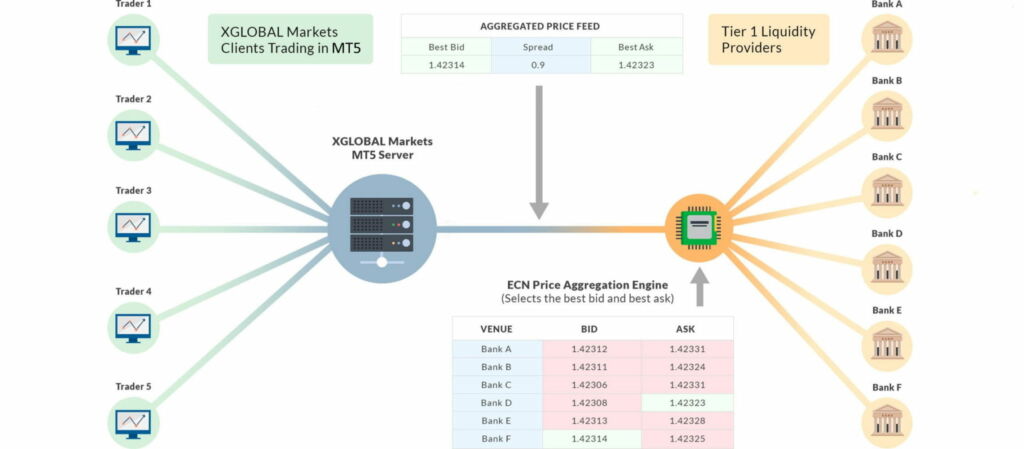

XGLOBAL streams an ECN price feed and executes client trades by internally matching them on its own book.

Excess net exposure is fully covered with third party liquidity providers.

ECN Pricing Model

Price Feed

We stream a low latency ECN price feed that is ultimately sourced from the best bid and ask prices available at interbank market participants. Depending on account type we charge either volume based commissions or a competitive spread to the feed to ensure client positions can comfortably be covered with third party liquidity providers if we are not able to internally match them.

Coverage Model

To ensure we maintain a win-win relationship with our clients and avoid conflict of interest we ensure the net exposure of our clients trades are covered. This allows XGLOBAL to support consistently profitable clients over the long-term. This is done by matching client trades internally or covering trades with external venues that cannot be matched internally. XGLOBAL’s fee is earned from the difference in price between client orders and either internally matched trades or externally covered net exposure.

Execution Speed

In the modern era of low latency price feeds and millisecond execution of market orders it is critical to facilitate the execution of client trades without delay. XGLOBAL has aimed to level the playing field for its clients and ensure they have the best chance of trading success by providing immediate market execution. To help, XGLOBAL trade servers are cross-connected and offer access points located all around the globe to ensure a good quality connection is always available worldwide. Excluding platform and network latency internal matching of orders typically happens in less than 100ms and external fills usually complete in 200ms resulting in high quality execution irrespective of order size.

Quality of Execution

The likelihood of receiving a complete fill for your order request is immensely important. Also, receiving a fill price either exactly or very close to the feed price at the time of order request can be even more important. XGLOBAL ensures these two metrics are met to the best of its ability by executing the vast majority of client trades on its own book. If orders are too large to be filled internally then they may be routed to external liquidity venues and filled in real time.

Minimizing Slippage

Slippage refers to an order being filled with a different price than that which was streamed by the price feed at the time of order request (or with a different price than requested when a limit order or stop is used). This can occur naturally when trades are either opened or closed using market or limit orders. It can be both positive (better price than expected) or negative (worse price than expected) and the split in this regard should be roughly 50/50. The two forms of natural slippage and why they occur are as follows:

- Latency based slippage – Occurs in volatile markets as the price moves between the time of order request and the time an order is filled.

- Volume based slippage – Occurs when an order is larger that the available top-of-book (level 1) price, so any overflow is filled at the next best pricing level(s) and the order is filled using a VWAP (volume weighted average price).

XGLOBAL does its very best to ensure slippage either does not occur or is kept to a minimum by following certain measures. These include using infrastructure that reduces order latency, matching trades on its own book whenever possible, and carefully selecting external liquidity venues with the best pricing at the deepest pricing levels available.